oklahoma franchise tax return form

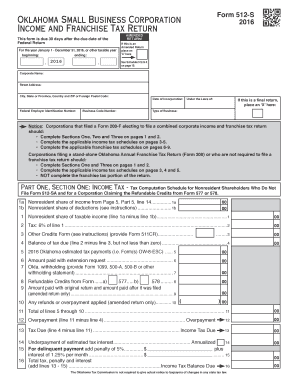

Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. Submit separate Form 512 pages 6-9 for each company within the consolidation.

Oklahoma State Tax Information Support

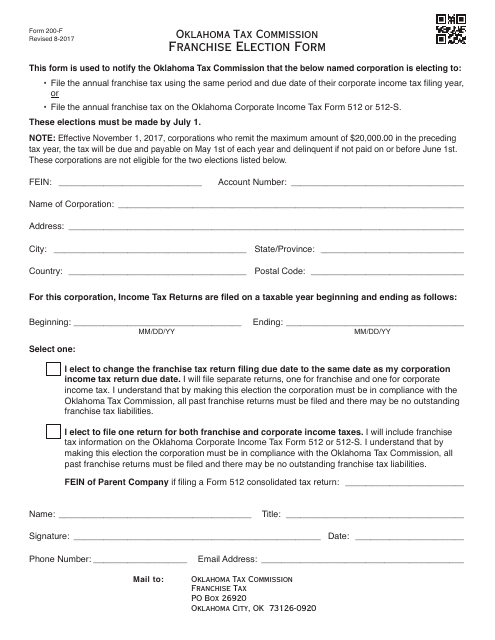

To make this election file Form 200-F.

. Complete OTC Form 200-F. Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form. Return was due between July 1 2006 and December 31 2007 and your capital is 8000 or less.

Franchise Tax Payment Options New Business Information New Business Workshop. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

You may file this form online or download it at taxokgov. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Special Instructions Regarding Form 512 Page 5.

Applications for refunds must include copies of your related Oklahoma Income Tax Returns. NOT have remitted the maximum amount of franchise tax for the preceding tax year. Do not use Form 512.

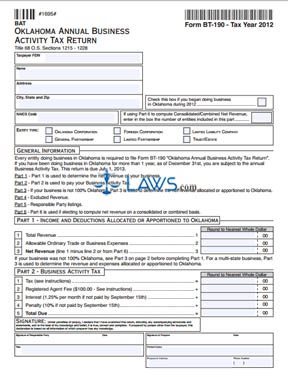

Oklahoma Annual Franchise Tax Return State of Oklahoma form is 4 pages long and contains. Oklahoma Annual Franchise Tax Return State of Oklahoma On average this form takes 62 minutes to complete. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999.

Prepare and file your Oklahoma Annual Franchise Tax Return and provide the businesss FEIN. Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free. Complete the applicable franchise tax schedules on pages 6-9.

You may file this form online or download it at wwwtaxokgov. File return payment balance sheet and schedules with the businesss FEIN or EIN. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form 512.

Return due January 1 2008 or later and your capital is less than 200000. For S corporations not. 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma.

These elections must be made by July 1. Maximum filers should complete and file Form 200 including a schedule of current If a taxpayer computes the franchise tax due and determines that it amounts to 250. Individual filers completing Form 511 or.

Corporations electing to file a combined income and franchise tax return should use this form when the Total Balance Due is income tax franchise tax or both. Foreign not-for-profit corporations however are still required to pay the 10000 registered agent fee. Oklahoma Annual Franchise Tax Return.

Instructions for Completing the MinimumMaximum Franchise Tax Return Who qualifies to File Form 215 Return was due prior to July 1 2006 and your capital is 8000 or less. Fill out and file Schedule A which provides the name and contact information for the businesss officers. All regular corporations and subchapter-S corporations are required to file Form 200 Annual Franchise Tax Return and pay franchise tax.

The State of Oklahoma like almost every other state has a corporation income tax. Tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. Corporations filing a stand-alone Oklahoma Annual Franchise Tax Return Form 200 or who are not required to file a franchise tax return should.

In Oklahoma the corporate tax is a flat 6 of Oklahoma taxable income. Use a oklahoma form 200 2021 template to make your document workflow more streamlined. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual.

Form 200-F must be filed no later than July 1. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma. The use of the correct corporate name and Federal Employer Identification Number on your return and all correspondence will facilitate processing and handling.

Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of the last preceding. How is franchise tax. Up to 25 cash back See the IRS website for the form Unlike the default pass-through tax situation when an LLC elects to be taxed as a corporation the company itself must file a separate tax return.

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of the last preceding.

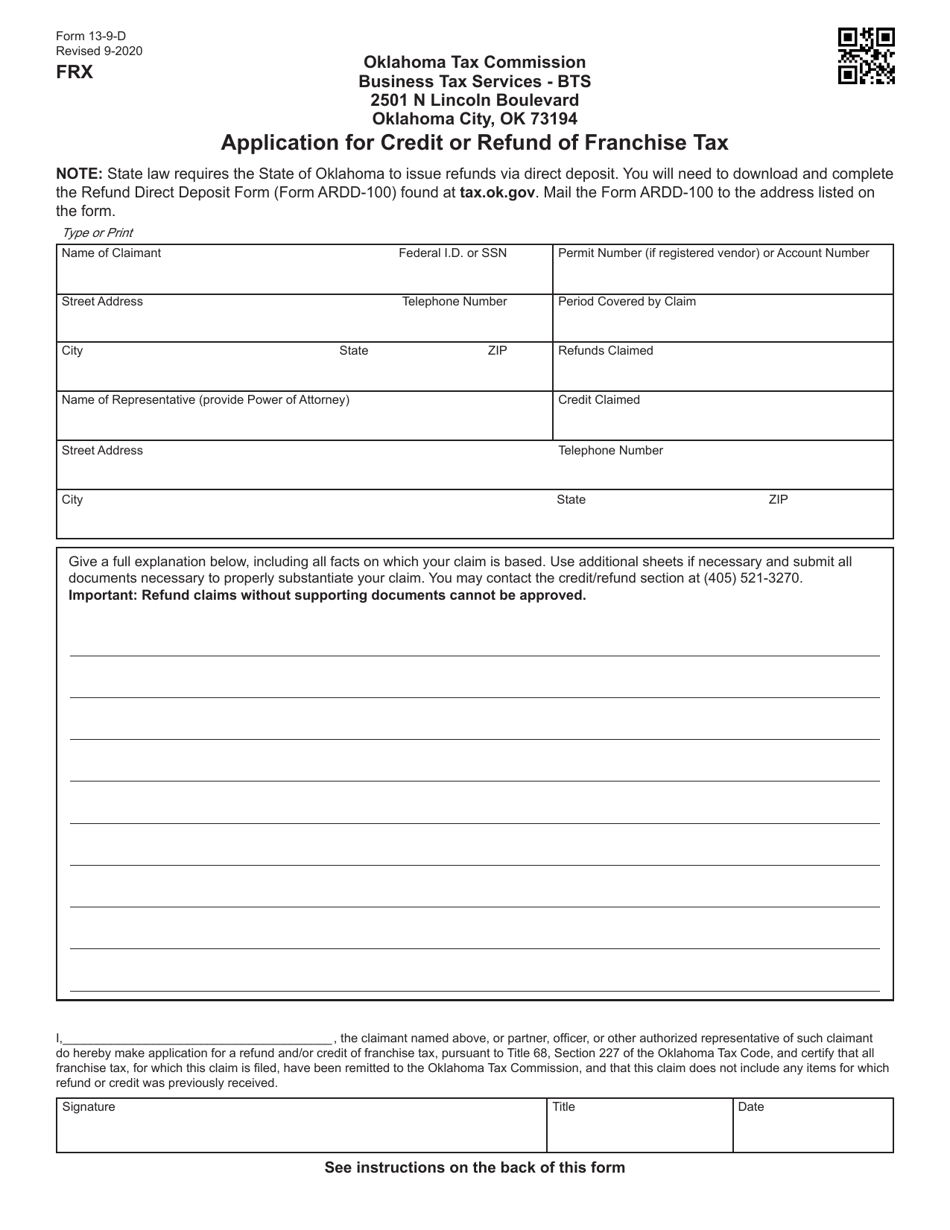

Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. A complete copy of the federal return must be provided with the Oklahoma income tax return. State of Oklahoma Business Filers Income Tax Payment Voucher Instructions 2020 Form EF-V This form is for Business filers completing Form 512 512-S 513 513NR or 514.

Complete Sections One and Three on pages 1 and 2. This page contains the Balance Sheet which completes Form 200. Forms - Business Taxes Forms - Income Tax Publications Exemption Letters All Taxes Income - Individual Income - Businesses Motor Vehicles Gross Production Online Registration Reporting Systems Rates Rebates.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. 1 120-S must le an Oklahoma income tax return on Form 512-S. When submitting the Franchise Tax Return foreign corporations must pay a 100 registered agensts fee.

LLCs are statutorily exempt from franchise tax. Complete OTC Form 200-F. To make this election file Form 200-F.

Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 18 25 of Form 512. 9242004 81317 AM. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Time for Filing and. Mine the amount of franchise tax due. To make this election file Form 200-F.

Income and Franchise Tax Forms and Instructions Oklahoma 2021-2022. Submit separate Form 512 pages 6 9 for each company within the consolidation. IReturn Oklahoma Annual Franchise Tax Return Revised 6-2017 FRX 200 Dollars Dollars Cents.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Form 200-F must be filed no later than July 1. Not-for-profit corporations are not subject to franchise tax.

Start A Nonprofit In Oklahoma Fast Online Filings

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

California Tax Forms H R Block

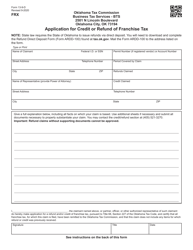

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller

What Is Franchise Tax Overview Who Pays It More

Where S My Refund Oklahoma H R Block

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk

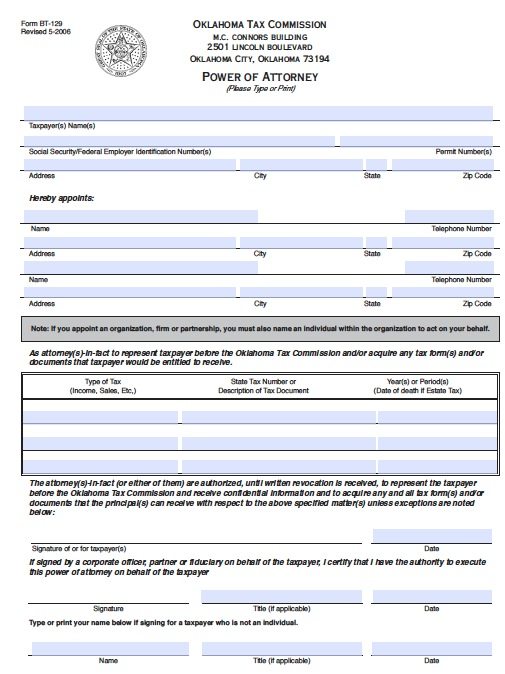

Free Tax Power Of Attorney Oklahoma Form Bt 129 Adobe Pdf

Fillable Online Form 512 S Fax Email Print Pdffiller

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller

Free Form Bt 190 Oklahoma Annual Business Activity Tax Return Free Legal Forms Laws Com