student loan debt relief tax credit for tax year 2020

Youre eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements your income after eligible. Complete the Student Loan Debt Relief Tax Credit application.

The Distributional Effects Of Student Loan Forgiveness Bfi

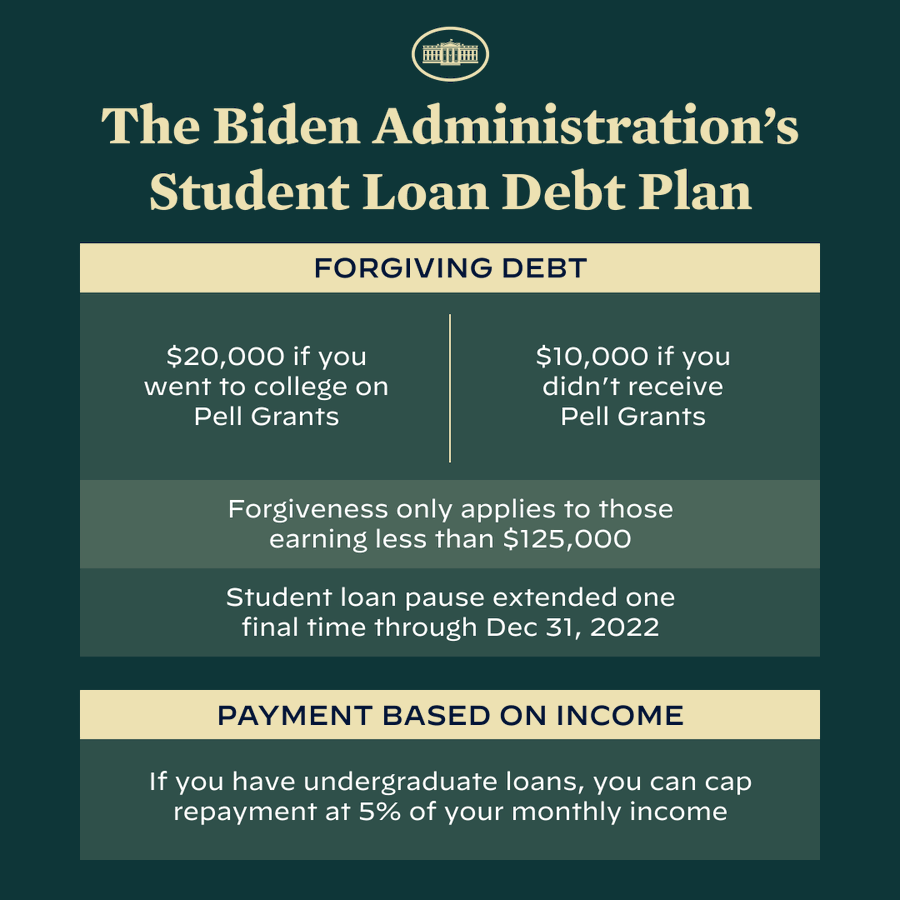

President Bidens move means the student loan balances of millions of people could fall by as much as.

. Governor Larry Hogan and Maryland Higher EducationCommission. Maryland taxpayers who have. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

As part of relief for the COVID-19 pandemic the federal Coronavirus Aid Relief and Economic Security CARES Act passed in March provides significant student loan relief in. Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt. What You Need to Know About Bidens Student Loan Forgiveness Plan.

Everyone is always looking for ways to reduce their tax liabilities but many people have no idea that this significant tax deduction is widely available. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Will have maintained residency within the state of Maryland for the 2020 tax year Have.

A copy of your Maryland tax get back for the most present past tax 12 months. You have at least 5000 in outstanding undergraduate student loan debt when you submitted an application for certification to the Maryland Higher Education Commission. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

Education loan Debt relief Taxation Borrowing having car title loan WY Tax Year 2020 Information Information We. From July 1 2022 through September 15 2022. From July 1 2022 through September 15 2022.

The Maryland Higher Education Commissionmay request additional. Maryland taxpayers who have. Student Loan Debt Settlement Tax Credit for Tax 2020 Details year This application together with instructions that are related for Maryland residents who would like to claim the.

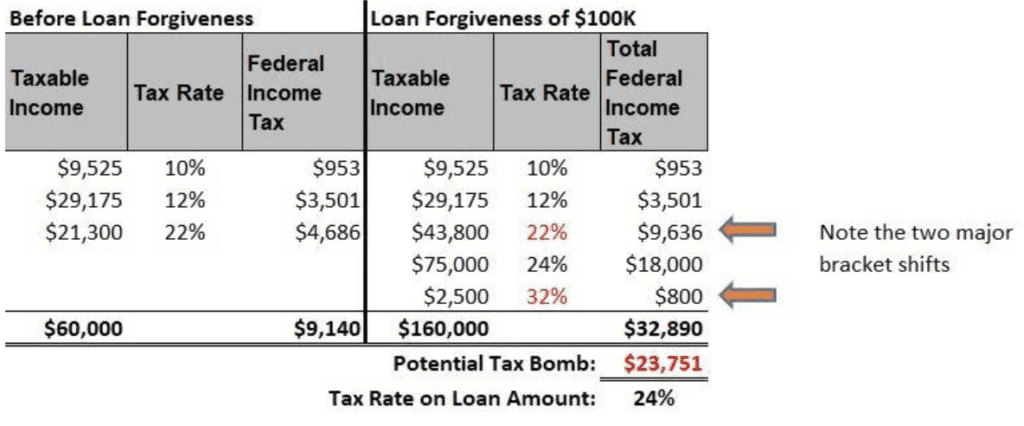

Instructions are at the end of this application. In fact the 2500 deduction can be. As a general rule a discharge of indebtedness counts as income and is taxable as my colleague Will McBride explains.

Complete the Student Loan Debt Relief Tax Credit application. In some states the answer could be yes. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

Whenever starting your bank account delight do not go into. T he deadline for Marylanders to claim the Student Loan Debt Relief Tax Credit worth up to 1000 is fast-approaching. If the credit is more than the taxes you would otherwise owe you will receive a tax.

The Biden administrations multi-part plan to provide student loan repayment relief for working and middle-class Americans will affect up to 43 million taxpayers. Last year approximately 9155 Marylanders received. If the credit is more than the taxes you would otherwise owe you will receive a tax.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. Student loan Debt settlement Income tax Credit to own Income tax Year 2020 Details.

Student Loans In The United States Wikipedia

2022 Student Loan Forgiveness Program H R Block

/cdn.vox-cdn.com/uploads/chorus_asset/file/22163262/Lespn_attitudes_toward_biden_canceling_student_debt_.png)

Can Joe Biden Cancel Student Loan Debt Without Congress Vox

Biden S Student Loan Forgiveness Could Be Taxable In Some States

If You Paid On Paused Student Loans You Could Get A Refund

Student Loan Forgiveness Statistics 2022 Pslf Data

The Student Loan Forgiveness Application Is Official 8 Things To Know The Washington Post

Biden Cancels 10k In Student Loan Debt Per Borrower What To Know Fox Business

Student Loans Aren T Going Away Any Time Soon So What S Next

What Student Loan Tax Credit Can I Claim Frank Financial Aid

Student Loans How To Apply For Loan Forgiveness Using The New Beta Version Of The Form Marca

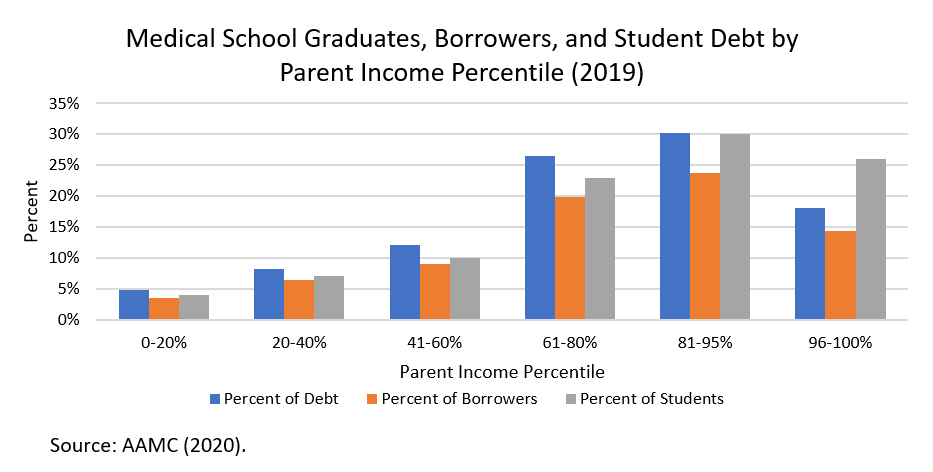

Who Owes The Most Student Loan Debt

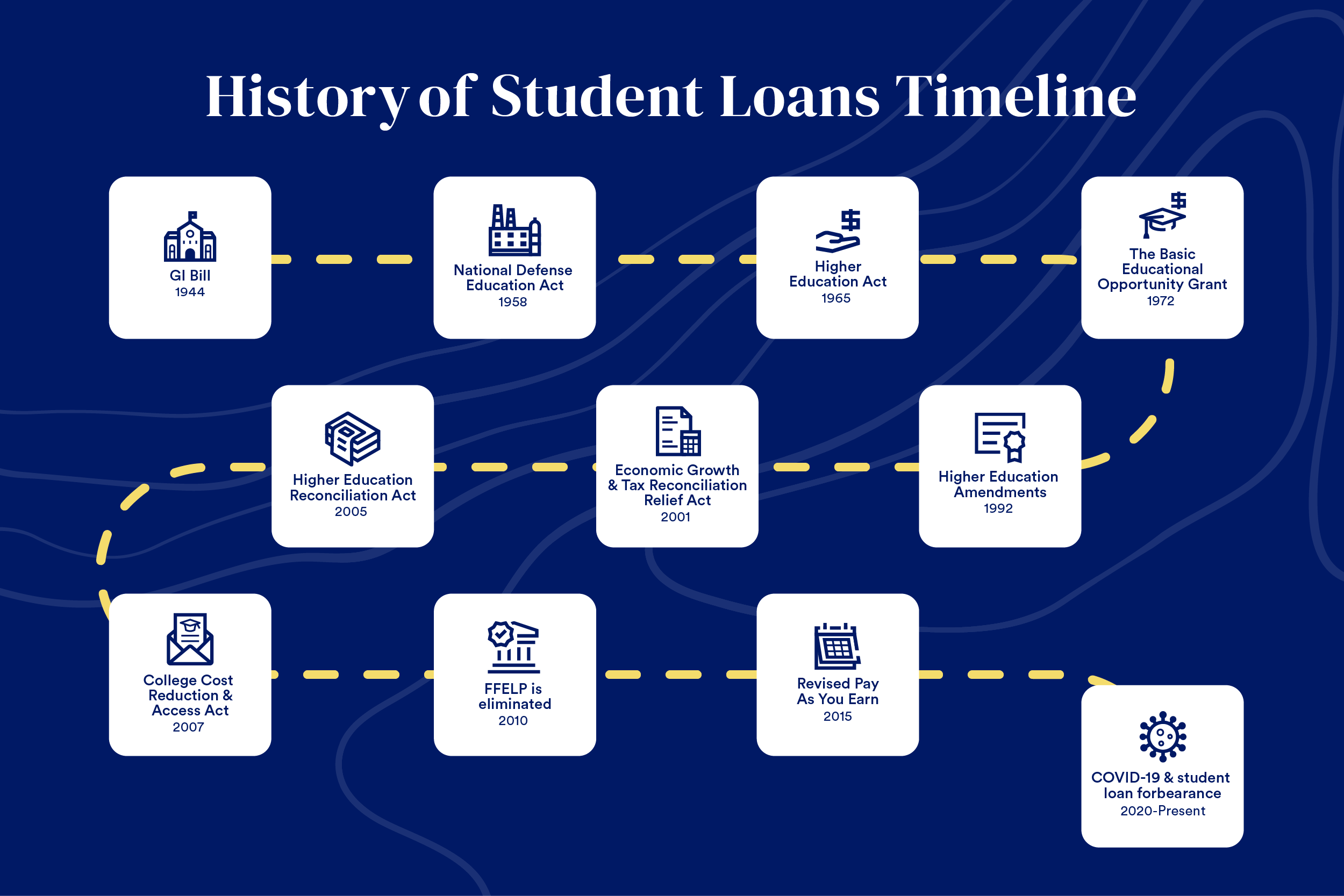

The Complete History Of Student Loans Bankrate

U S Appeals Court Temporarily Blocks Biden S Student Loan Forgiveness Plan Reuters

See How Average Student Loan Debt Has Changed In 10 Years

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Means Testing Student Debt Relief Big Hassle No Results The American Prospect

How To Claim The Maryland Student Loan Tax Credit Fire Esquire

Conservatives Are In A Legal Battle To Stop Biden S Student Loan Forgiveness Npr